Bootstrapping Zero Coupon

Recent site instability major outages JulyAugust 2022. Ad Find the best Discounts coupon promo codes and deals for August 2022.

Estimating The Zero Coupon Rate Or Zero Rates Using The Bootstrap Approach And With Excel Linest Youtube

Save Money on the Stores You Love - Join Now.

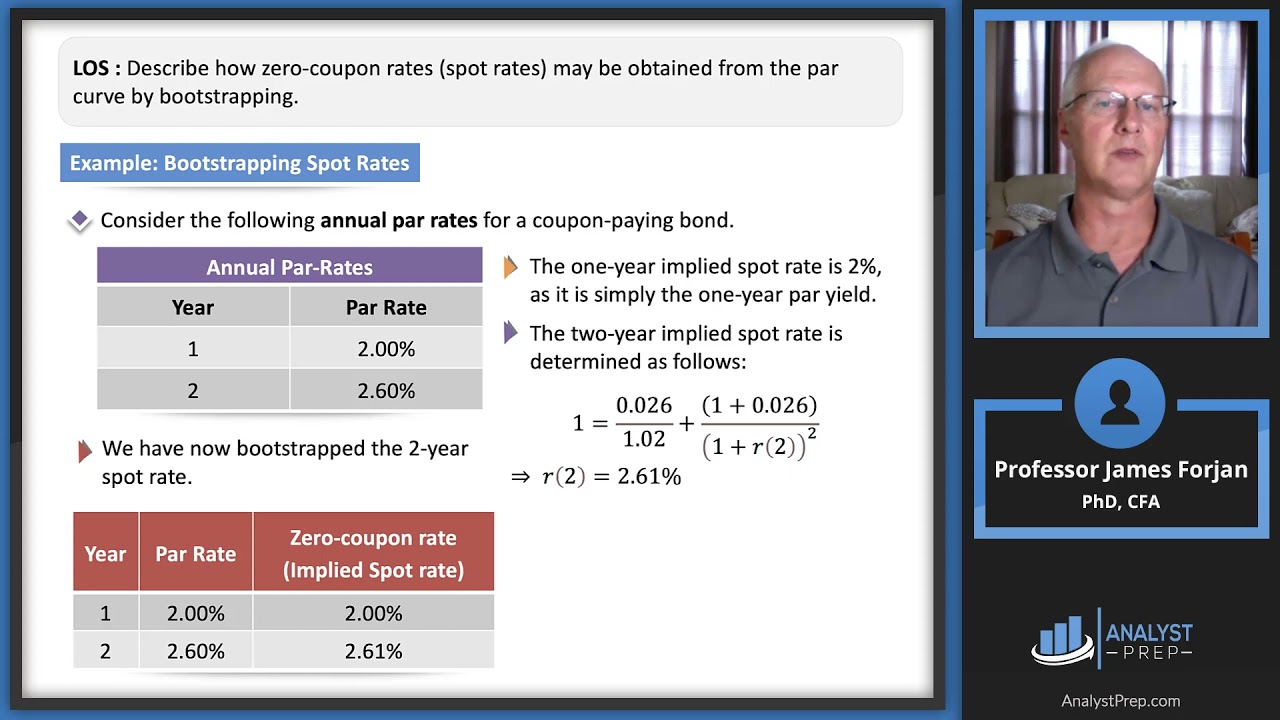

. This means that the discount factors derived from bootstrapping can be applied to arrive back at the market swap rates used in their. Deposit and futures have one bullet payment at maturity but IRS has in-between cash flows. Bootstrapping Spot Rates Consider the following annual par rates for a coupon paying bond.

Bond Coupon rate pa. The bootstrap method that this function uses does not require alignment among the cash-flow dates of the bonds in the input portfolio. Bootstrapping is a method for constructing a zero-coupon yield curve from the prices of a set of coupon-bearing productsAs you may know Treasury bills offered by the government are not available for every time period hence the bootstrapping method is used mainly to fill in the missing figures in order to derive the yield curve.

To reiterate the spot curve is made up of spot interest rates for zero coupon bonds of different maturities. The zero coupon rate therefore would be the rate that discounts the cash flows to this value ie. Newly Updated Promo Voucher Codes Coupons for August.

Given a Future price the yield or zero rate can be directly calculated as 𝑟 100𝑃 100 𝐶𝑣𝑥𝐴𝑑𝑗 10000 where P. The bootstrapping method To overcome these problems one constructs a zero-coupon yield curve from the prices of these traded instruments. Featured on Meta Please welcome Valued Associate 1301 - Emerson.

Using these zero-coupon products it becomes possible to derive par swap rates forward and spot for all maturities by making a few assumptions eg. In finance bootstrapping is a method for constructing a zero-coupon fixed-income yield curve from the prices of a set of coupon-bearing products eg. The face value of all three bonds equals 1000.

Ad Weve Paid Our Members Over 2 Billion in Cash Back. One needs to have valuation models for each instrument. We use the bootstrapping bonds method to derive the zero curve from the par term structure.

How to bootstrap zero coupon rates and what is the relationship with par yields 0 I understand the basic logic of bootstrapping zero coupon rates take a bond discount each cashflow at the prevailingpreviously solved zero rate. Start Earning Cash Back Every Time You Shop. For example 3-year zero rates is calculated by using the 3-year swap pricing.

Calculate Spot Rates Using Treasury Yields In this step we will apply the bootstrapping method to calculate the spot rates. Bootstrapping the zero coupon yield curve is a step-by-step process that yields the spot rates in a sequential way. Bootstrapping Consider two zero bonds and one coupon bond with the coupon being paid once a year given in the following table.

Browse other questions tagged fixed-income yield-curve bootstrapping zero-coupon bootstrap or ask your own question. 11215 1. Explore These Promo Codes and Save More.

Planned maintenance scheduled for Tuesday August 23 2022 at 0000-0300 AM. As a reminder the zero-coupon rate is the yield of an instrument that does not generate any cash flows between its date of issuance and its date of maturity. This is an iterative process that allows us to calculate a zero coupon yield curve from the rates prices of coupon bearing instruments.

Shop at Over 3500 Stores Get Paid. All bootstrapping methods build up the term structure from shorter maturities to longer ones. Get the best deal with our latest coupon codes.

A zero curve consists of the yields to maturity for a portfolio of theoretical zero-coupon bonds that are derived from the input Bonds portfolio. Bootstrapping spot rates using the par curve is a very important method that allows investors to derive zero coupon interest rates from the par rate curve. It uses theoretical par bond arbitrage and yield interpolation to.

Bootstrapping involves obtaining spot rates zero-coupon rates for one year then using the one-year spot rate to determine the 2-year spot rate and so on. Price Maturity A 0 93293 1 B 9 100312 2 с 0 76918 3 a Calculate the discount factors for all three maturities. This process needs information of 025 05 075 25 275 3 year zero rates.

Bootstrapping produces a no-arbitrage zero coupon yield curve. The slightly difficult part is to bootstrap zero rates from market swap rates for IRS. Spot rates obtained through bootstrapping are known as implied spot rates.

Ad Stop Paying the Full Price. That is we first obtain the spot rate for one year.

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

What Is Bootstrapping Learn The Cfa Level I Concept

Bootstrapping Spot Rates Cfa Frm And Actuarial Exams Study Notes

0 Response to "Bootstrapping Zero Coupon"

Post a Comment